Explaining 99-1: What's Illegal in the PropNex Drama?

Oops! Someone just got hit with a $1.2M tax bill.

So here’s the tea: a businessman named Melvin Li is suing PropNex Realty, their agent, and a law firm because they allegedly told him a sneaky property trick was legit. Now he’s stuck with a $1.2 million tax bill! 😱

Here’s what went down: Li bought a 1% stake in each of his parents’ new condos (Pullman Residences and Piccadilly Grand). The idea? He’d only pay ABSD (Additional Buyer’s Stamp Duty) on that tiny 1% while still being able to help finance the purchases through bank loans.

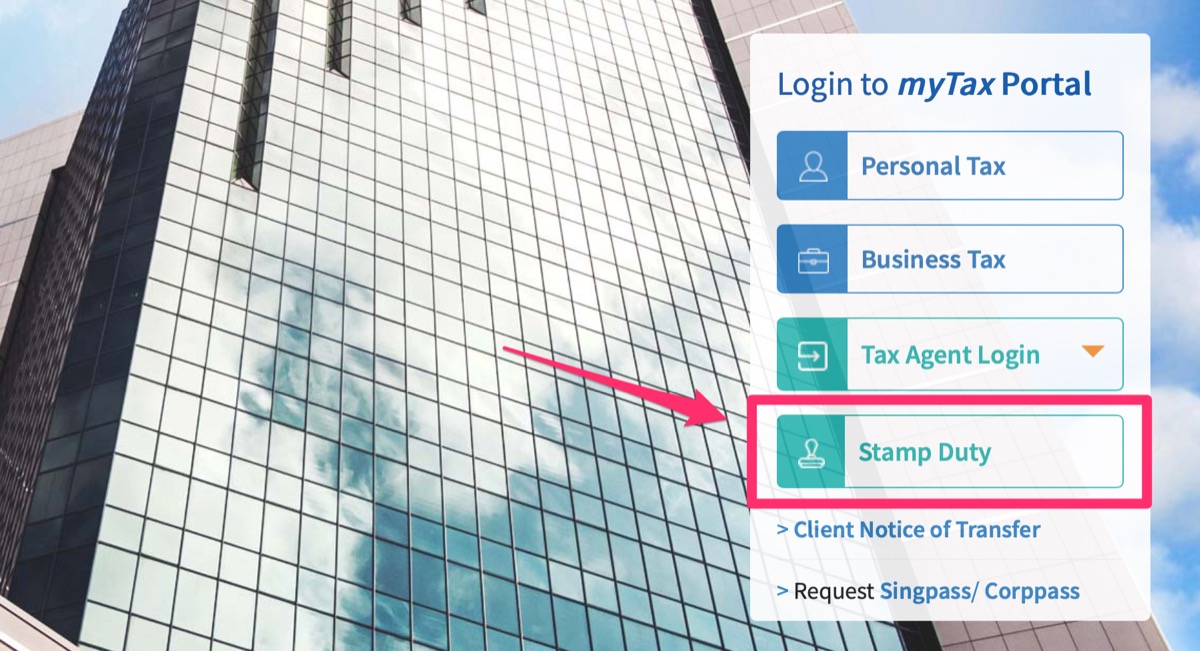

Spoiler alert: IRAS wasn’t having it. They came after him for the full ABSD plus penalties!

How is this “99-1” illegal?

We covered a year ago on how 99-1 can be legal. Yep, you hear it right, it can be legal.

But it will be illegal, if it is carried out in 2 stages.

The main difference is that the illegal 99-1 avoid paying full ABSD on the whole purchase price. This illegal approach is also known as 100-sell-1, as there is an additional selling/transfer of share.

Once again, you can still split 99-1 legally

The 99-1 split isn’t dead – it’s just grown up! Use it for what it’s meant for: smart long-term property planning, not quick tax tricks.

To be fair on this lawsuit, no one in the industry, or the lawyers, see that coming back then. It was a legal loophole, until IRAS decided to not only close the loophole, but clawback those that exploited it!